Imagine trying to rent a car in Lisbon, open a local bank account, or even buy a bottle of wine at the supermarket—only to be asked for a NIF Portugal. Without this tiny 9-digit number, life in Portugal grinds to a halt. But what exactly is this golden ticket, and why does it matter so much? Let’s pull back the curtain.

Whether you’re planning to invest in Portuguese real estate, retire under the Algarve sun, or simply explore this vibrant country long-term, your NIF (Número de Identificação Fiscal) is the first step. Think of it as your financial passport to Portugal.

Understanding the NIF Portugal: Your Key to Everyday Life

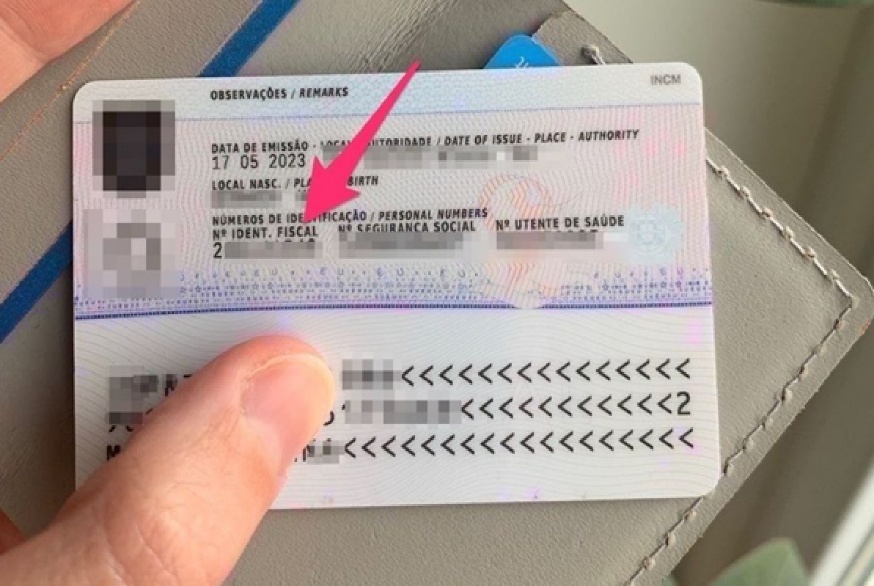

The NIF Portugal isn’t just another bureaucratic number—it’s your lifeline. Officially known as the Portuguese Tax Identification Number, it’s required for almost every transaction in the country. From signing a lease to setting up utilities, paying taxes, or even getting a gym membership, your NIF is how Portugal tracks your financial footprint.

But here’s the kicker: You don’t need to be a resident to get one. Even non-residents, retirees, or investors eyeing Portugal’s Golden Visa program must obtain a NIF. It’s like a backstage pass that lets you navigate the country’s systems smoothly.

Why such strict rules? Portugal uses the NIF to combat tax evasion and ensure transparency. Without it, you’re essentially invisible to the system—and that’s a problem if you want to buy property, start a business, or enjoy healthcare here.

Why You Can’t Afford to Skip a Portuguese Tax ID

Let’s cut to the chase: No NIF, no life in Portugal. Here’s why this number is non-negotiable:

✅ Investing in Property: Dreaming of a villa in Porto or a beachfront condo in Lagos? You’ll need a NIF to sign deeds, pay taxes, or even negotiate with sellers.

✅ Opening a Bank Account: Portuguese banks won’t let you deposit a single euro without this number.

✅ Accessing Healthcare: Even private clinics require a NIF for billing.

✅ Starting a Business: From registering your company to hiring employees, the NIF is your foundation.

✅ Daily Transactions: Renting a car? Buying a SIM card? Surprise—they’ll ask for your NIF.

Think of it as the Swiss Army knife of Portuguese bureaucracy. Without it, you’re stuck on the sidelines.

Step-by-Step Guide to Getting Your NIF

Getting a NIF Portugal isn’t rocket science, but it does require careful planning. Here’s how to nail the process:

- Determine Your Residency Status

- EU/EEA Citizens: You can apply on your own with minimal paperwork.

- Non-EU Citizens: You’ll need a local representative (like a lawyer or fiscal agent) to act on your behalf.

- Gather Required Documents

- Passport (or EU ID card)

- Proof of Address (utility bill, rental contract—even from your home country)

- Portuguese Tax Form (Modelo 11, filled out by your representative)

- Choose Your Application Route

- In-Person: Visit a Finanças office (tax authority) in Portugal.

- Online/Remote: Use a trusted intermediary to handle everything digitally.

- Submit and Wait

Processing takes 1-3 weeks, depending on workload. Once approved, your NIF arrives via email or post.

Pro Tip: Non-EU applicants often hit snags without a local rep. Hiring a professional saves time and headaches.

Online vs In-Person: Which NIF Application Route is Right for You?

Let’s break down the pros and cons:

| Method | Pros | Cons |

| In-Person | Faster processing (sometimes same-day) | Requires physical presence in Portugal |

| Online/Remote | No travel needed; ideal for non-EU applicants | Requires hiring a local representative (€200-€500 fees) |

For retirees or investors outside Portugal, the remote route is a no-brainer. Yes, it costs extra, but avoiding flights, hotels, and language barriers? Priceless.

What Does a NIF Portugal Cost—and How Long Will It Take?

Good news: The NIF itself is free. But there’s a catch.

- Government Fees: €0 (unless you need urgent processing).

- Representative Fees: €200-€500 for non-EU applicants.

- Legalization/Translation: €50-€150 if documents aren’t in Portuguese.

Processing times vary:

- In-Person: 1-5 business days.

- Remote: 1-3 weeks.

Why the wait? The tax office verifies your details and runs anti-fraud checks. Delays often happen if documents are incomplete or incorrectly translated.

FAQs: Quick Answers to Your Burning Questions

- Can I get a NIF without a Portuguese address?

Yes! You can use a foreign address, but some services (like banking) may require a local contact later.

- Do I need a NIF to invest in Portugal’s Golden Visa program?

Absolutely. Your NIF is Step 1 before you can even apply for the visa.

- Is the NIF the same as a residency visa?

No. The NIF is a tax ID; residency permits allow you to live in Portugal. You need both for long-term stays.